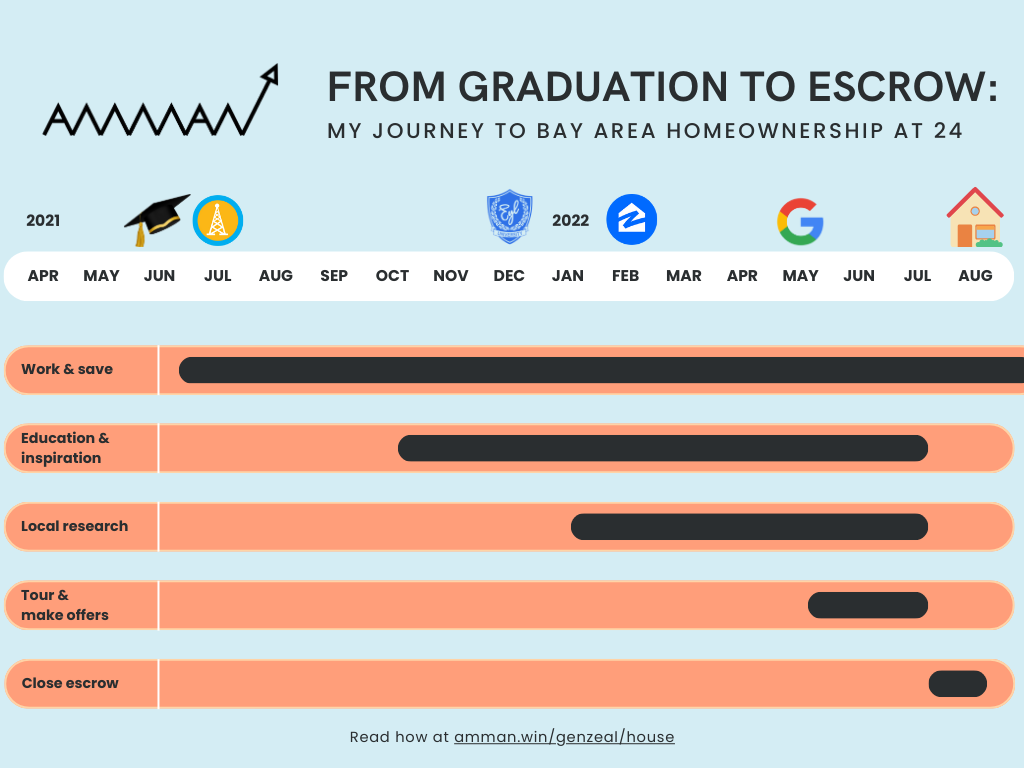

From Graduation to Escrow: How I Bought a House in the Bay at 24

Within a year of finishing college, I made and used this “Purchase or Pass” calculator to to guide me towards my first real estate investment.

tl;dr—Below is a free “Purchase or Pass” house hacking calculator and article with 7 steps explaining how in summer 2022 I bought a 3 bedroom, 2.5 bathroom, 1500 square foot townhouse in Oakland, California at 24 years old. This is not financial advice. Use my experience for educational, inspirational or reference purposes only. Your process will not be the same as mine.

I hope young, unmarried professionals in America avoid being trapped by the cycle of re-signing 12-month apartment leases every year. House hacking your home or owning a duplex/triplex are both financially lucrative ways for early-career professionals to enter the real estate market. It’s a good first step towards the illustrious goal of “financial freedom” or living “rent free”.

STEP 1: Take a look at the “Purchase or Pass” house hacking calculator sheet I made below. Once viewing on desktop, click “File” then “Make a copy” to add it to your Google Drive. To edit, open the copied file in Google Sheets.

This sheet is the “calculator” I used to objectively assess every single property I was interested in.

If the sheet outputted “PURCHASE” three or four times in the “DECISION” column, then I sent it to my realtor for a second opinion and physically visited the property.

Are you confused? If yes, good, because you need to keep reading this article plus other online resources!

STEP 2 (recommended): Obtain college degree or certificates while minimizing your student loan debt. Your studies should clearly lead you to a stable profession in the workforce. Duration: up to 48-60 months (4-5 years).

I went to college for 5 years and graduated with a bachelor’s and master’s in electrical engineering.

While in school, I worked internships and part-time jobs and won scholarships to gradually pay off all my unsubsidized student loans (~$5,000).

In my Junior year, I attended a money management workshop by a Black alum, Stephan Cheek, where I first learned of house hacking through his testimonies.

By sophomore year, I had the Chase Freedom Unlimited credit card and by Junior year, I had the Chase Sapphire Preferred credit card. I responsibly built good credit history by using my credit cards for purchases that I already had the cash for or for fronting NGO expenses that would be reimbursed by the on-campus org I led (Cal Poly NSBE).

I graduated in 2021 with a total of $22,000 in federal subsidized student loan debt. Luckily, there was a federal loan payment pause until 2023, due to the pandemic. I took advantage of this.

If you are drowning—or even wading—in student loan debt, it will work against you in the final step of home buying called escrow.

What you do/did before graduation influences what you can do after graduation. If you’re curious, below is a book I wrote about my first year of college:

STEP 3: Begin working in your profession for an employer with solid salary/wage compensation while living in a modest place where the end of your lease will turn into a month-to-month rental. While working, set up automatic transfers to your savings account based on a frugal budget and stick to it. Duration: at least 12 months; ongoing.

I moved into a small, family-owned, 1 bed, 1 bath apartment in a complex with only 12 units in downtown Oakland. My dad and I negotiated the 12-month lease down to 6 months with the landlord’s son. After 6 months the lease became month-to-month, giving me the freedom to leave anytime I find a new opportunity.

For about 12 months I worked a contracted engineering job with a startup consulting firm that compensated me solely through hourly wages—meaning they offered zero equity, no 401k plan, and no health benefits…

I was okay with this because I had no dependents and was under 26, so I was still under my family’s health care plan.

My savings goal was to reach $40,000 cash with extra reserves sitting in stocks, crypto, and retirement accounts.

Your savings goal is essentially your upfront investment limit and thus your home buying budget!! (see calculator in Step 0)

My first job after graduation: a contracted engineer role that paid handsomely by the hour… a story for another day.

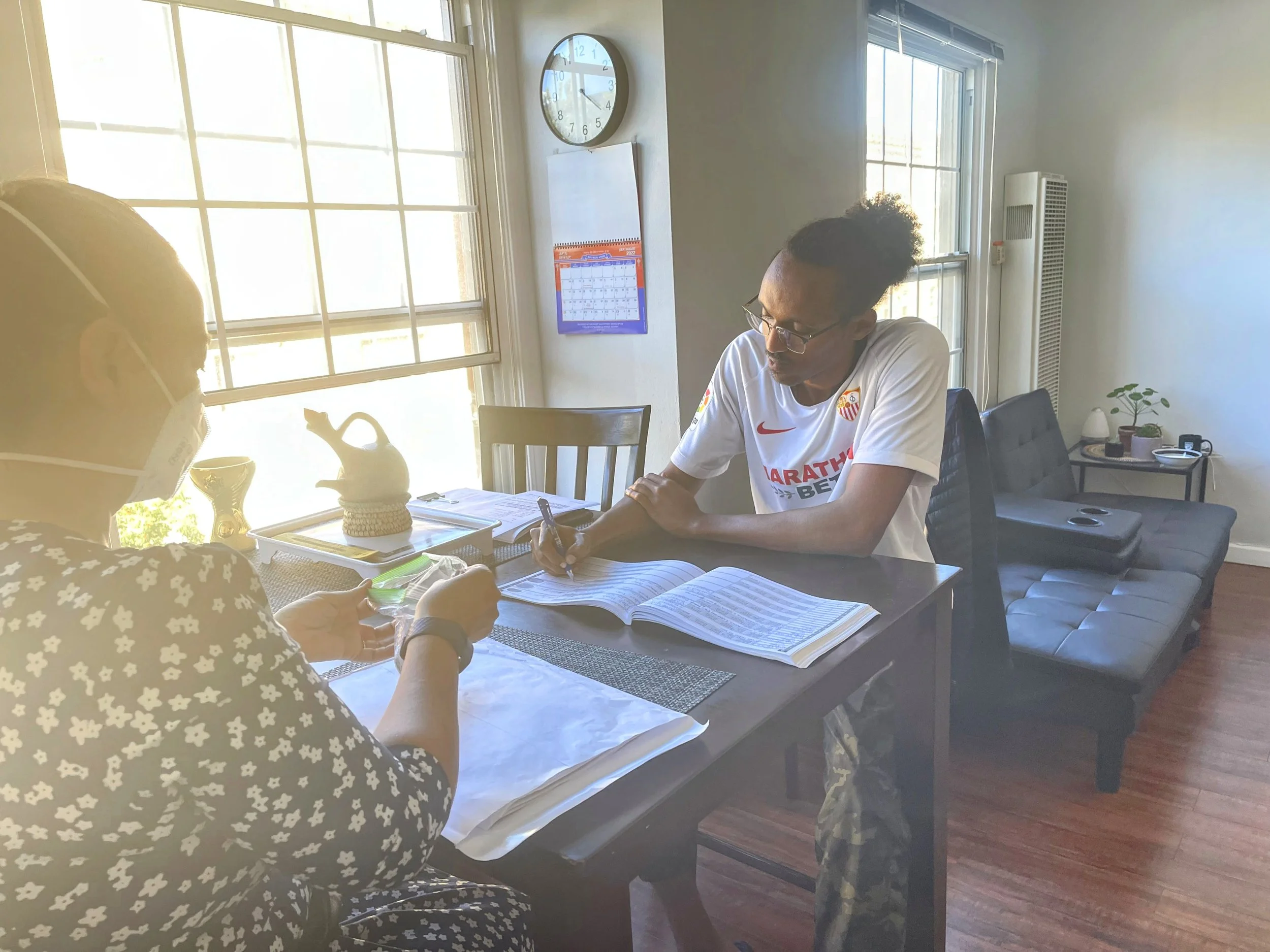

STEP 4: While working and saving, educate and inspire yourself on real estate investment through social media, webinars, conferences, and articles. I consumed all of this information for free. I think this is the step people overlook the most. You really gotta study again like school. This is how you learn of resources, programs, etc. Duration: at least 3 months, up ‘til escrow.

On social media, I watched and followed folks who looked like me such as @julliengordan.

In December 2021, I attended a free Home Buying Expo in-person in Oakland by EYL (Earn Your Leisure).

I attended one free online webinar in April 2022 by Jullien Gordon’s Multifamily Movement, leading me to recreate his Purchase or Pass calculator which is linked in Step 0.

Last but not least, I READ numerous articles online explaining complex real estate concepts, laws, terms, acronyms, etc.

STEP 5: While working and saving, conduct local research by physically visiting neighborhoods and configuring Zillow filters with email notifications based on your needs and wants. Look for neighborhoods that you can comfortably jog or bike through. Duration: at least 4 months, up ‘til escrow.

The neighborhoods I could afford were limited so I didn’t have to do too much exploring. I mainly drove through east and west Oakland.

I referred to people familiar with various neighborhoods so as to collect qualitative sentiments and history. Certain things just aren’t on the internet…

Once I had an idea of the local market, I realistically defined my criteria for my future property.

First, I defined my non-negotiables and needs. Then, I defined my wants and nice-to-haves.

Configuring Zillow filters was key because it consistently and immediately notified me on the latest listings. This is important for the next step of placing (timely) offers.

After months of continuous Zillow research of various neighborhood listings and using the Purchase or Pass calculator as a litmus test, I started to develop an eye / gut instinct on what is a good deal vs bad deal without even needing the calculator.

STEP 6: While working and saving, begin serious research alongside an experienced realtor you trust. Promptly tour newly listed properties in person, ready to place an offer at any moment. Getting pre-approved for a loan with a reputable bank shows realtors your serious. Duration: at least 2 months up ‘til escrow.

Fortunately, my realtor was my trusted uncle, Solomon Bekkele (510) 282-9365 who’s been in the industry over 20 years.

Even with a realtor, I drove the online search process because I preferred configuring my own Zillow filters.

Uncle Solomon drove the property touring and negotiation process of placing the offer.

Amazingly, we only toured two properties and negotiated one successful offer on the second property.

There is some aspect of chance/luck in getting your offer accepted by the seller. Ultimately, the seller is considering picking you. They have to like the offer and the idea of selling to you.

The one and only, Solomon Bekkele! If you’re looking to buy in the Bay Area, hit him up.

solomonbek@coldwellbanker.com

STEP 7: Vigilantly and tactically close escrow by making it through the lender’s underwriting process. It is a game of big bank vs. little bank. A poker hand of the big stack vs. short stack where you might have to go all in. The institutional lender tries to squeeze poor you out of as much upfront money as possible.

This was by far the most frustrating and difficult step in my home buying process. My escrow was a 30 day window where I had to obtain final approval for my loan and make the transaction with the seller.

First, Chase bank reviewed every single penny to my name, past and present. I notified them of every account I had, in the hopes that it would increase the probability of being approved for a loan. Being a 24-year-old Black male in America, I didn’t want to take any chances.

Chase bank approved my home loan, but only on the condition that I paid off $5,000 of my student loans. This was on top of the ~$50,000 that would be due at closing. THEN, a few days after I paid off that condition they added a “final” condition to pay off another $3,500 of my student loans!

These conditions were so I would fall within their required DTI (debt-to-income) ratio limit. And it ate up all my reserves, which Chase knew about since I revealed all my financial accounts with them for review—ouch.

I essentially had to go all in to meet the Chase underwriter’s conditions. This is where I had to tap into my retirement, brokerage, and crypto accounts. Without my reserves I would not have been able to close escrow.

Understanding the game of poker helped me rationalize my escrow moves: If I’m the short stack, in order to win a big pot against the big stack, I may have to go all in… especially when I’ve been lured to stay in ‘til the river card.

Note that I dealt with all this even though two months prior I obtained a more stable job with a well known employer: Google. I do think my Google employment helped convince the underwriter to approve my loan.

The home buying process takes months—if not years—to complete so stay passionate, persistent, and patient! When all was said and done, all I could say was thanks be to GOD!! 🙏🏾

WARNING! Real estate investing is ultimately a RISK. The wrong moves or uncontrollable changes in the circumstances could result in one losing it ALL. My personal approach to this is:

1) Calculate the risks, then manage/handle them accordingly (see calculator in Step 0 😄).

2) Remind myself I’m not married to “my” money nor will I die with it. Meaning that if I do lose it all, then so be it because I can always work to make/create more money. As they say, “only invest what you’re willing to lose.”

For the record: My family and friends did NOT help me finance my home purchase. In fact, they admonished my home buying ambitions early on. My parents immigrated to America in the 90s and never owned real estate nor attended college. They did throw me an amazing housewarming party though 😊.

The iconic key-holding photo of me is the type of image most people see. Yet we rarely hear the back story of how folks get to holding that new house key. Hence why I’m sharing my firsthand experiences with you. If you would like to read more personal stories from me, please consider purchasing my freshman memoir below or reading the free PDF version here.